For last-mile banking services, MSMEs favor Aadhaar Banking at 38% and UPI at 43%.

- 38% of MSMEs prefer Aadhaar Banking while 43% favor UPI for last-mile banking services.

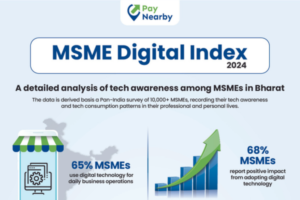

- 65% of MSMEs incorporate digital technology into their daily operations.

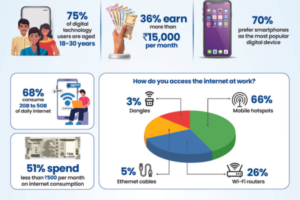

- Among the users of digital technology, 75% are between the ages of 18 and 30.

- For daily operations, 26% of respondents rely on mobile hotspots, 66% use Wi-Fi routers, 5% utilize Ethernet connections, and 3% use dongles.

- 72% of MSME retail entrepreneurs use YouTube for entertainment.

- The most popular programs used by MSMEs to manage their businesses are accounting software (29%) and POS software (17%).

- 68% of MSMEs use 2 to 5 GB of internet data daily for work-related purposes.

The MSME sector in India is expanding rapidly, and in recent years, there has been a discernible change in the attitudes of small business owners regarding the use of technology.

Over 65% of Micro, Small, and Medium-Sized Enterprises (MSMEs) use digital technology in some capacity for their everyday business operations, according to a recent study by PayNearby, India’s top digital network and branchless banking provider.

The study also highlighted the fact that 68% of MSMEs recognised the expansion and advantages of implementing digital technology in their personal and professional life.

The information was provided as part of a comprehensive survey called the “MSME Digital Index 2024,” which PayNearby launched today. The report is a Pan-Indian analysis that highlights the use of technology by MSMEs in the final mile.

When asked how technology has helped their firms develop, 31% said it has done so by increasing operational efficiency, and 27% said that using technology has increased sales and income.

Regarding the primary obstacles to using technology for corporate operations, 36% of respondents mentioned opposition to using new technology, and 18% mentioned the high implementation costs.

It is interesting to note that 52% of respondents said that English was their favourite language for using technology and transacting business, with Hindi coming in second at 21%.

Within the financial services sector, MSMEs utilising Aadhaar banking at 38% and UPI at 43% were the two most widely used banking services at the final mile.

Furthermore, with a 97% usage rate, WhatsApp and WhatsApp Business were together the most popular messaging apps.

The company conducted a nationwide survey among 10,000+ MSMEs in the retail space (kirana stores, mobile recharge stores, medical stores, customer service point (CSPs), travel agents, among others) to record their awareness of and patterns in tech consumption in their personal and professional lives. This survey served as the basis for the report’s second edition.

The survey found that 75% of small business owners between the ages of 18 and 30 were the most digitally savvy, with over 87% of this age group utilising smartphones to access digital material and conduct everyday business. The age range of 31 to 40 years old came in close second. Remarkably, 36 percent of them stated that they earn more than ₹15,000 each month.

The internet plays a vital role in overcoming infrastructural gaps and boosting digital inclusion among MSMEs at the grassroots level, as seen by the growing use of smartphones.

Smartphones are the most widely used digital device, with 70% of users preferring them. Of those surveyed, 68% said they used their smartphones for work-related purposes and used 2 to 5 gigabytes of data every day.

More than half of these companies use the internet for less than ₹500 a month. The BharatNet project and the Digital India mission have sped up the adoption of internet in rural regions, lowering costs and closing the digital divide.

Around 66% of people used mobile hotspots for internet access at work, with Wi-Fi routers coming in second at 26%. Merely 5% and 3% of respondents utilised Ethernet cables and dongles, respectively. 75% of people used mobile internet at home to stay connected.

With 36% of users spending 4-6 hours on their phones, the majority of users of digital devices doing so for work-related purposes. However, the survey found that 66% of respondents spent less than three hours on leisure activities like social networking or online entertainment.

YouTube was found to be the most popular app for social networking (41%) and entertainment (72%). It’s interesting to note that 58% of respondents said their phones were empty of any gaming apps.

According to the report, 29% of all tech-savvy MSMEs managed their business operations with accounting software, followed by point-of-sale (POS) and customer relationship management (CRM) software at 17% and 14%, respectively.

Conversely, 6% of respondents said they only utilise manual techniques and don’t use any software. In response to a question concerning the usage of digital devices in corporate operations, 41% of respondents said that they were used to expedite processes, while 18% said that technology was used to track business spending and streamline financial transactions.

This emphasises how important it is to build a robust tech ecosystem in order to empower MSMEs and accelerate their expansion for a more powerful Bharat.

Commenting on the report findings, Anand Kumar Bajaj, Founder, MD & CEO, PayNearby, emphasised, “The MSME sector is pivotal to our economy, and their adoption of digital technologies is crucial for India’s growth. The MSME Digital Index 2024 showcases significant progress in technology adoption while highlighting persistent challenges. We believe that MSMEs should be supported in their digital transformation journey and ensure that technology’s benefits reach every corner. By leveraging artificial intelligence (AI), augmented reality (AR) and machine learning (ML), MSMEs in rural India can thrive in a digital-first economy. We must foster an inclusive ecosystem that enhances skills and removes barriers, enabling all businesses to embrace digitalisation. Together, we must envision a future of limitless opportunities, driving economic growth and social upliftment in the real Bharat.”