In collaboration with Setu and supported by Bharat BillPay, a service provided by National Payments Corporation of India (NPCI), Tide1, an Indian corporate financial platform, has introduced a Bill Payments functionality.

The feature would offer micro, small, and medium-sized enterprises (MSMEs) all throughout India a hassle-free, interoperable, and accessible bill payment option. Small business owners, who usually employ between zero and ten employees, frequently resort to using their personal account for both personal and business expenses in an attempt to keep running costs to a minimum.

This practice inevitably leads to an accounting nightmare and decreases visibility into business expenditures. Small company owners will no longer experience this typical problem thanks to Tide Billpay.

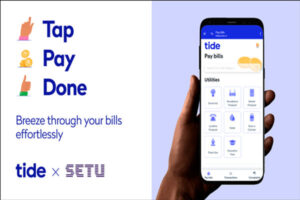

MSMEs constantly struggle to pay their business expenses. With Tide’s Bill Payments, MSMEs can pay for a variety of utilities, insurance premiums, loan payments, municipal taxes, and postpaid mobile and broadband bills, all from the company’s mobile app.

Small company owners will be able to make payments more quickly, conveniently, and securely with Bill Payments. The Bharat Bill Payment System provides users with a variety of payment options.

The transaction history will make it simple for Tide Members (customers) to identify categories of outgoing expenses for their business. Members will also be able to track and trace payments related to their business. This will offer them a more comprehensive and in-depth understanding of their cash flow and, consequently, the immediate and long-term well-being of their company.

Modern security techniques like authentication and encryption are used in this functionality. Transparency is facilitated by bill payments since users receive instant confirmation of their payments. Members will be able to use the new Tide function around-the-clock and make payments from anywhere at any time.

Kumar Shekhar, Deputy Country Manager, Tide in India, said: “India’s dynamic SMEs fuel the country’s economic growth. Tide stands at the forefront of innovation to help them save time and money. Our Bill Payments feature alleviates the pain point that bill settlements pose for small business owners. With a focus on agility, convenience, ease of use, security and accessibility, we are committed to help simplify the bill payments experience for India’s MSMEs.”

By the end of 2024, Tide hopes to have on boarded half a million SMEs in India. Tide is attempting to establish a sizable company in India because they think there is a big possibility there.

The company intends to launch numerous additional features for India’s small enterprises. A business savings or current account, bank transfers, GST, pay via link, and credit services are a few of them. In order to better serve the needs of MSMEs in India, Tide is attempting to expand the breadth of its product offering from the UK to India.

The Tide business account can be opened anywhere in India at any time, as it is a digital-only service. For Android smartphones, the Tide app is now accessible through the Google Play Store.